Supported housing exists to help people to live as independently as possible, helping improve their quality of life, their well-being, their health, and their employment prospects. Yet people in supported housing face a specific barrier and disincentive to work due to the way the welfare system is configured.

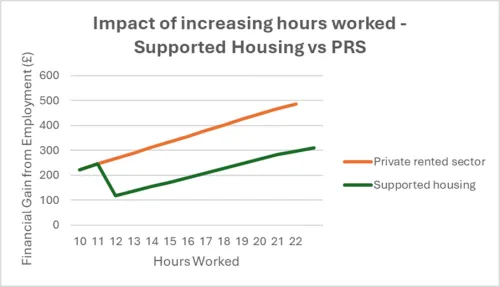

Whereas people in receipt of benefits in the Private Rented Sector become steadily better off the more they work, people in supported housing see their benefits taken away more quickly and can actually become worse off when they work more hours.

This is because of an anomaly in the benefit system where people in supported housing are still receiving Housing Benefit for their rent but are on Universal Credit for their living costs. The way these two benefits interact, and the high Housing Benefit taper rate (set at 65%), means that people hit a ‘cliff edge’ after which they become worse off as they increase their hours. This puts residents at risk of accruing arrears as the rent becomes unaffordable.

Because of this cliff edge and the fear of people not being able to afford their rent, we often see residents' securing jobs that they need to turn down because they are ‘too many hours’. People with existing full-time jobs are asking to have their hours reduced or are giving up their employment entirely if part-time hours are not possible. Residents can also understandably be anxious about entering employment whilst in supported housing, due to the complexity and risk associated with the current benefit rules.

When St Mungo’s clients were asked in its 2023 survey - ‘What barriers put you off from going into work, if any?’ 27% of its residents stated ‘I'm concerned that working whilst living in homelessness accommodation will cause problems with my benefits’.

We want our residents to experience the benefits of employment whilst living in supported housing; the current benefit system does not support this.

The solution

The Government can eliminate the work disincentive faced by all residents in supported housing by making a combination of minor adjustments to the benefits system:

- We recommend that the Housing Benefit disregard is increased from £5 to £57.

The Housing Benefit disregard is the amount of a person’s earnings or income that is excluded from benefit calculations, so increasing this would ensure that most people living in supported accommodation would not face a financial cliff edge and instead would be incrementally better off as they increase their working hours. Increasing disregard rates supports employment goals, reduces benefit traps, and promotes long-term independence; it could be the difference between a stable step forward to independence or a return to crisis.

- Reduce the taper rate from 65% to 55% to bring it in line with Universal Credit.

In addition to raising the disregard, parity between the Universal Credit and Housing Benefit taper rates is required to remove the work disincentive. We recommend the government reduces the Housing Benefit taper rate from 65% to 55% to bring it in line with Universal Credit. This would effectively reduce the amount that people living in supported accommodation are being taxed for accessing work, as their Housing Benefit would be reduced at a lower rate than it currently is (55p for every pound earned, as opposed to 65p on every pound).

To eliminate the cliff edge for all, both of these measures are needed. Taken together, these two measures will remove barriers to employment that are currently experienced by people in supported housing. This will create a clear progression whereby as people increase their hours and progress in work, they see their incomes increase and can build financial resilience to move on into independent accommodation.

Impact

- Supported housing residents would not be worse off when they increase their working hours and instead would see a rise in their income.

- Supported housing residents would be more likely to maintain their employment or enter employment because they would no longer be at risk of losing income and accruing rent arrears.

Conclusion

Through a combination of measures to resolve this anomaly in the benefit system, the Government can open opportunities for people in supported housing to gain and retain employment. There is a clear desire to work among supported housing residents, with a St Mungo’s survey finding that 63% of its residents in supported housing want to work and 5% are already in work.

Implementing these changes would ensure that supported housing residents are genuinely better off for every additional hour worked. These measures would remove key financial disincentives, align Housing Benefit with Universal Credit, and give supported housing residents the confidence to access employment without the risk of losing income or falling into rent arrears. In doing so, the Government can support more individuals on the path to financial independence and make work pay for all.